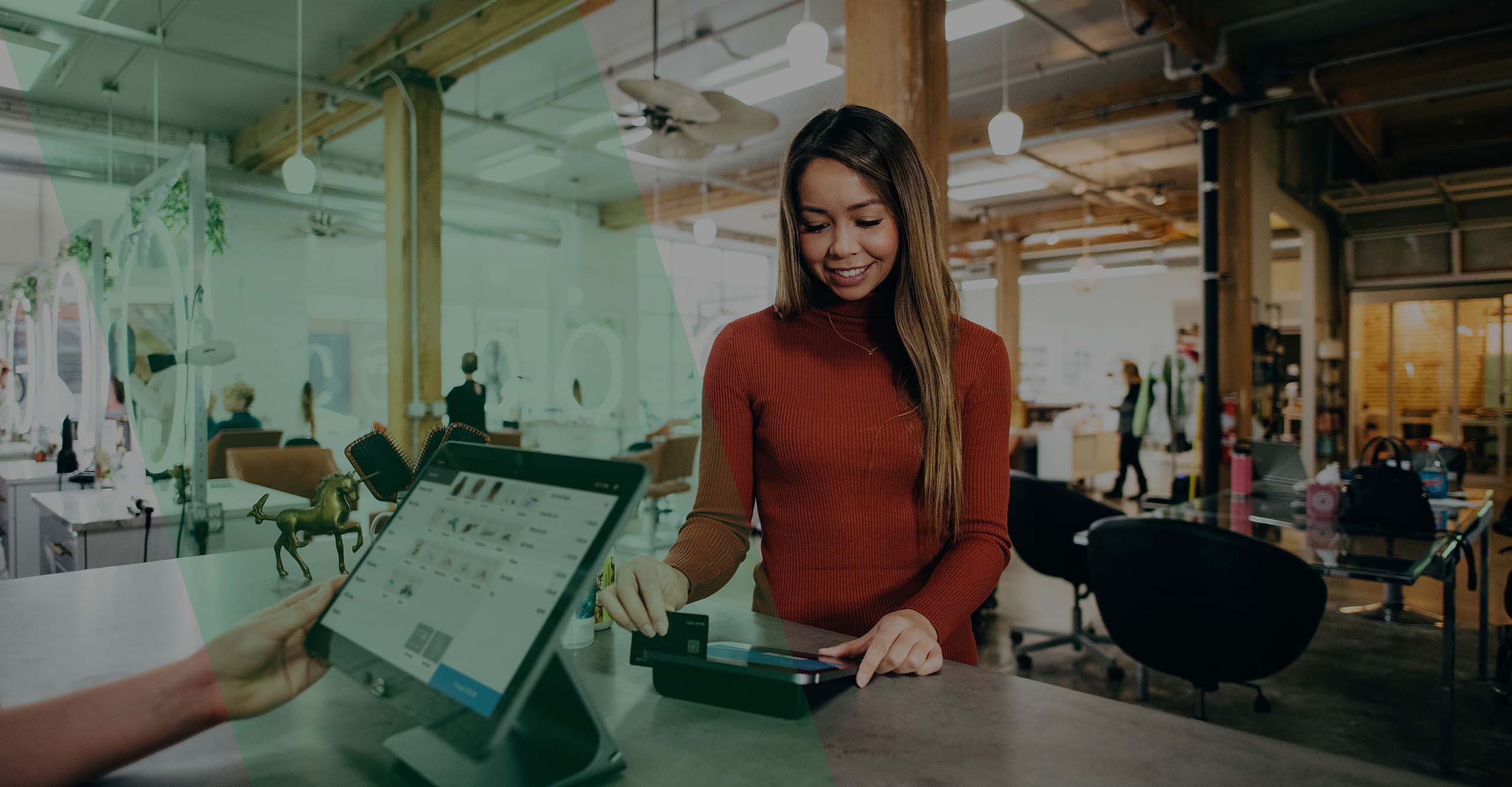

Our Products

As the leading electronic payment solution provider, UTA will help you find the optimal processing solutions to enhance your cash flow and eliminate processes that are inefficient by offering cost-effective products to manage your receivables and customer payments.

We Love Numbers

Today, thousands of prominent companies and industry leaders rely on UTA as their payment solution provider.

Average Annualized

# of Transactions

Average Annualized Volume

Average Check Approval Rates

Average Customer Retention Rate

Industry Leader

Understanding your needs is an important component to finding the right payment solutions that work smarter for your business and harder for your money.

This is why some of the largest companies in these industries rely on UTA for payment processing.

Auto Dealers (% of Top 20 companies)

80Building Material (% of Top 20 companies)

80Furniture (% of Top 20 companies)

32Electrical Distributors (% of Top 20 companies)

65HVHC/Plumbing (% of Top 20 companies)

55Our Clients

What Our Clients Have To Say

American Furniture Warehouse

We have been doing business with UTA since 2004. They do everything they can and more to accommodate our check guarantee needs at a rate that rivals any competitor. UTA works very well with our customized payment system and does an outstanding job."

El Dorado Furniture

UTA is one company that follows through with what they promise. Our electronic transactions are delivered on time every time, Guaranteed!"

Latest news posts

As we welcome 2025, businesses are preparing for a year of economic opportunities. However, as economic opportunities rise, so do financial challenges. According to recent reports, the Federal Reserve's latest interest rate adjustments could further impact credit card transaction costs for merchants. These rising expenses make it more critical than ever for businesses to find cost-effective solutions to manage payment processing fees.

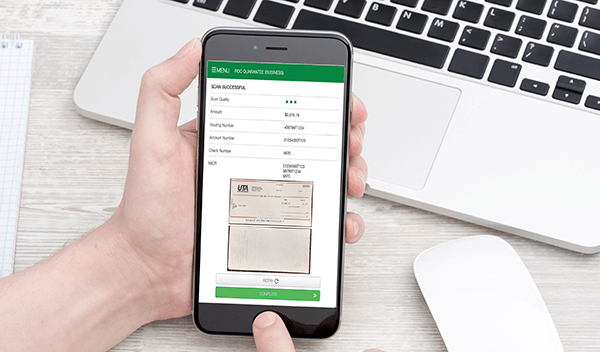

In the rapidly evolving world of business, adaptability and streamlined operations are crucial for success. Companies are increasingly adopting mobile payment solutions to keep operations running smoothly, no matter where business takes place. Mobile-first payment options aren’t just a convenience—they’re a necessity for businesses looking to stay competitive in a world where speed and accessibility are critical.

An increase in transactions often brings higher costs, particularly in credit card processing fees. As businesses look for ways to protect their bottom line, surcharging has emerged as a practical solution to manage transaction costs while still offering flexible payment options to customers. Here's how surcharging can help your business and tips to implement it effectively.